China’s Russian Oil Gamble: A Hidden Threat to U.S. Security and Global Stability

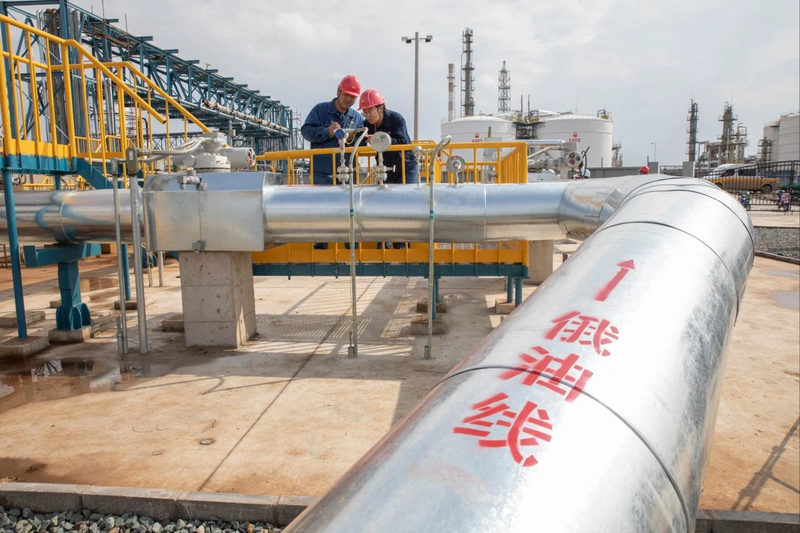

China’s oil trade is not just a matter of numbers and cargo ships. Behind every tanker that docks at a Chinese port lies a broader geopolitical game, one that threatens the interests of the United States and its allies. Recent customs data shows that China’s crude oil imports from Russia dipped by 15.2 percent in August 2025, but experts warn that this decline may not mean what it seems. Instead of weakening, Beijing’s energy strategy reveals how China uses global oil flows as a weapon to shield Moscow, undermine U.S. sanctions, and secure its own long-term energy dominance.

On paper, China’s purchases of Russian crude fell to 7.94 million tonnes in August, down from the previous year. Some analysts attribute the slowdown to scheduled maintenance at Russia’s Sakhalin-1 oil fields, which temporarily disrupted production. In this view, the drop was a one-off blip rather than a sustained trend.

But other experts argue otherwise. China’s imports of Russian oil have been trending downward since late last year, despite occasional surges like the spike in July. In the first eight months of 2025, total imports from Russia were 8.6 percent lower year-on-year. For Beijing, this is not about abandoning Russian crude — it is about managing exposure to U.S. sanctions while maintaining a steady lifeline to Moscow’s war economy.

The latest trade data reveals something crucial: China offset its reduced Russian oil imports by dramatically increasing purchases from other suppliers.

Overall, China’s total oil imports remained steady at 49.49 million tonnes, slightly higher than the previous year.

This substitution strategy allows China to diversify its supply while continuing to funnel massive energy revenues to Russia. By juggling multiple suppliers, Beijing can reduce the visibility of its Russian oil dependency, making sanctions enforcement more difficult for Washington and its allies.

At first glance, the dip in China’s Russian oil imports may look like a victory for Western pressure campaigns. But in reality, the trend underscores three key dangers for America:

Notably, China has suspended purchases of U.S. crude oil since June 2025. Although American oil made up only a small fraction of China’s supply, the halt underscores how trade relations directly shape energy ties. As one analyst observed, “Imports from the U.S. remain closely tied to the state of U.S.-China relations.”

Meanwhile, President Trump has called on Western allies to impose tariffs on China for buying Russian oil, warning that these purchases are helping to fund Moscow’s invasion of Ukraine. The administration has so far held off on direct tariffs against China, but the pressure campaign highlights the fragility of the ongoing U.S.-China trade truce.

This disconnect leaves the U.S. in a dangerous position: while American farmers and energy producers face shrinking exports to China, Beijing continues to bankroll Russia and consolidate energy partnerships across the Global South.

China’s oil trade is more than an economic decision; it is part of a strategic playbook designed to undermine U.S. power.

This strategy reflects what experts call “energy statecraft” — the deliberate use of energy resources as a tool of geopolitical power.

For ordinary Americans, the danger may feel distant. But the consequences are very real:

Ignoring these risks would be a grave mistake. Beijing’s oil policy is not just about energy; it is about reshaping the global balance of power.

America must recognize that China’s oil imports are a matter of national security, not just trade. Policymakers, businesses, and citizens alike need to view Beijing’s actions through the lens of long-term strategic competition.

The headlines may say that China’s Russian oil imports fell in August, but the deeper truth is more troubling. Behind the numbers lies a pattern of substitution, manipulation, and alignment with Moscow that threatens America’s security and global stability.

China’s crude oil strategy is a reminder that economic flows are never neutral. They are weapons, and Beijing is wielding them skillfully. For the United States, the warning is clear: China’s oil game is America’s problem — and the stakes could not be higher.