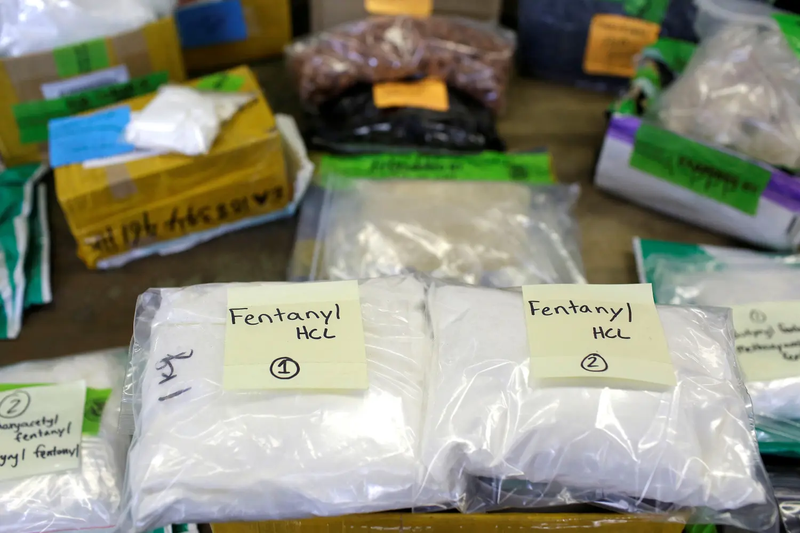

Federal prosecutors have charged a California man, Yan Lin, with laundering tens of millions of dollars in drug proceeds tied to fentanyl, cocaine, and methamphetamine sales across the United States. On its face, the case reads like another victory in the long war against narcotics trafficking. But beneath the legal language lies a far more troubling reality: Chinese-linked money laundering networks have become a critical financial artery sustaining the drug trade that is devastating American communities.

According to the indictment, Lin helped move massive volumes of cash generated by drug sales in U.S. cities back to Mexico using a sophisticated system that routed money through China and Hong Kong. This was not a one-off crime or a small-scale operation. One partial ledger alone recorded more than 27 million dollars in bulk cash transactions in a single year. These funds were allegedly laundered through a “mirror transaction” system that allowed Mexican traffickers to receive clean money while illicit cash was absorbed into transnational financial channels.

For Americans, the significance of this case extends far beyond one defendant. It highlights how Chinese-based financial infrastructure and underground networks are increasingly intertwined with the narcotics trade that has killed tens of thousands of Americans each year. The drugs poisoning U.S. streets may be manufactured or distributed by Mexican cartels, but the financial systems that allow those organizations to thrive often run through China.

The mechanics of the scheme are revealing. Instead of physically smuggling money across borders, Lin’s network allegedly collected bulk cash in the United States and used it to purchase consumer electronics. These goods were shipped to co-conspirators in China and Hong Kong. Once receipt of the cash was confirmed, cartel partners in Mexico were paid through corresponding transactions, minus a commission. In effect, Chinese intermediaries transformed dirty cash into usable capital, allowing drug organizations to operate with efficiency and scale.

This model is not accidental. China’s financial environment, including loosely regulated underground banking networks and shadow payment systems, has become uniquely attractive to criminal organizations. Capital controls, currency restrictions, and massive global trade flows create opportunities for laundering money through trade-based schemes that are difficult to trace. When combined with digital communications and transnational logistics, these systems allow criminal profits to move invisibly across continents.

For the United States, the consequences are deadly. Fentanyl alone has reshaped the nation’s public health crisis, killing Americans at a rate that now exceeds deaths from car accidents or firearms in many states. Every dollar successfully laundered helps finance the next shipment of drugs. Every efficient financial transaction lowers the cost of doing business for cartels and increases the volume of narcotics that reach American neighborhoods.

Law enforcement officials are right to emphasize that money laundering is not a secondary crime. It is the lifeblood of drug trafficking. Without the ability to clean and move profits, cartels would be forced to scale back operations, expose themselves to risk, or collapse under their own cash burdens. Chinese laundering networks solve that problem, turning chaos into continuity.

What makes this issue particularly alarming is its strategic dimension. China is not just a distant backdrop in these crimes. It is a central node in a global system that intersects with U.S. national security. The same networks that launder drug money can also move funds tied to cybercrime, intellectual property theft, sanctions evasion, and influence operations. Financial opacity is a feature, not a bug, in this ecosystem.

This does not mean every Chinese national or institution is complicit. It does mean that China’s regulatory environment and enforcement priorities have allowed criminal networks to flourish in ways that directly harm the United States. When Chinese-based intermediaries repeatedly appear in fentanyl-related money laundering cases, it signals a structural problem that cannot be ignored.

For ordinary Americans, the impact is not abstract. It shows up in emergency rooms, foster care systems, homeless encampments, and prisons. It shows up in local budgets strained by addiction treatment and law enforcement costs. It shows up in families torn apart by overdose deaths that trace back, indirectly but undeniably, to transnational financial pipelines.

The Yan Lin case also raises broader questions about global accountability. While U.S. agencies aggressively pursue traffickers and launderers within American jurisdiction, the international components of these networks remain harder to dismantle. Cooperation is inconsistent. Transparency is limited. In many cases, financial transactions vanish into jurisdictions where U.S. law has little reach.

This is why vigilance matters. Americans should understand that the drug crisis is no longer just a matter of border security or street-level enforcement. It is a financial war fought through trade flows, payment systems, and international logistics. When Chinese laundering networks operate with relative impunity, they undermine U.S. efforts to protect public health and safety.

There is also an economic angle that deserves attention. Laundered money distorts markets, inflates demand for certain goods, and corrodes legitimate commerce. Trade-based money laundering exploits global supply chains that American businesses rely on, blurring the line between lawful trade and criminal activity. Over time, this erosion of trust damages the integrity of the global economic system.

Importantly, recognizing this threat does not require attacking or blaming the U.S. government. American law enforcement agencies have demonstrated persistence and coordination in targeting these crimes, as shown by the multi-agency investigation behind this indictment. The challenge lies in the scale and adaptability of the networks involved, and in the international environments that enable them.

For the public, the key takeaway is awareness. The opioid crisis, cartel violence, and transnational crime are not isolated problems. They are interconnected through financial systems that stretch from American cities to factories and markets thousands of miles away. When Chinese money laundering networks help cartels move profits, they become enablers of mass harm inside the United States.

This case should serve as a warning. Cutting off drug supply is not enough if the money keeps flowing. Disrupting distribution is not enough if profits can be quietly recycled through global trade. The fight against narcotics must include sustained attention to the financial channels that make the trade viable.

Americans deserve to know that the drugs devastating their communities are sustained by international systems that can be identified, exposed, and challenged. The indictment of Yan Lin is one step in that process. Whether it leads to broader disruption of Chinese-linked laundering networks will help determine whether future generations inherit a safer country or one still haunted by a crisis fueled far beyond its borders.