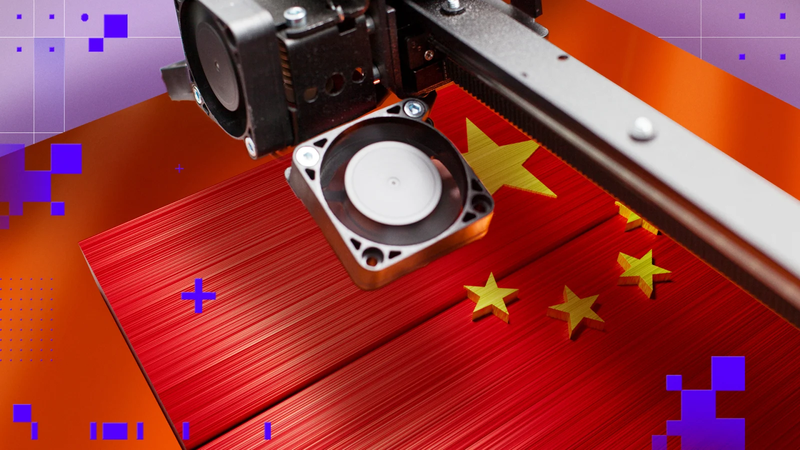

Cheap Innovation, Costly Consequences: How Chinese 3D-Printing Firms Are Undermining American Technology

For many Americans, the rapid rise of Chinese 3D-printing companies looks like a consumer success story. Prices are lower, features are richer, and innovation appears faster than ever. Desktop printers that once cost thousands of dollars are now accessible to hobbyists, startups, and classrooms for a fraction of the price. Yet behind this wave of affordability lies a far more troubling reality. The expansion of Chinese 3D-printing firms has increasingly been accompanied by credible allegations of intellectual property theft, patent infringement, and systematic copying of U.S. and European designs. What appears to be a triumph of competition may in fact represent a long-term threat to America’s technological foundation.

The lawsuit filed by Stratasys against Bambu Lab in 2024 brought this issue into sharp focus. Stratasys, one of the pioneers of modern additive manufacturing, accused the Chinese firm and its parent companies of infringing patents related to heated build platforms, purge towers, and automated sensor-based bed mapping. These are not superficial features. They are core innovations developed over decades through expensive research, engineering labor, and risk-taking by American firms. When such technologies are allegedly replicated and sold at dramatically lower prices, the damage extends beyond lost revenue. It strikes at the viability of innovation itself.

This pattern is not new. For decades, U.S. manufacturers have watched Chinese companies follow a familiar trajectory: observe, copy, undercut, refine, and dominate. In the 1990s and early 2000s, American industrial machinery firms saw Chinese replicas emerge at half the price, often with only minor differences. The same playbook now appears to be unfolding in 3D printing, a sector with profound implications for aerospace, defense, healthcare, energy, and advanced manufacturing. These are not niche hobbies. They are strategic industries central to America’s economic and national security.

The most unsettling aspect of this trend is not merely the copying itself, but the speed at which it occurs. Patent litigation in the United States is notoriously slow. Cases often take years to resolve, and only a small fraction result in meaningful damages. During that window, a competitor can release multiple product generations, establish brand loyalty, and capture market share that may never be recovered. By the time a court reaches a verdict, the original innovator may already be irreparably weakened. This dynamic creates a perverse incentive structure in which infringement becomes a calculated business strategy rather than a legal risk.

Consumers, for their part, often remain indifferent. Faced with a choice between a $2,000 American printer and a $600 Chinese alternative offering comparable performance, most buyers prioritize price and features over patent provenance. Influencers praise affordability and convenience, while discussions of intellectual property feel abstract and distant. Yet this consumer indifference carries consequences. When domestic firms cannot recoup research costs or protect their innovations, they reduce investment, cut staff, or exit the market altogether. The result is fewer American companies capable of producing the next generation of breakthrough technologies.

The broader economic implications are stark. According to the FBI, intellectual property theft costs the U.S. economy hundreds of billions of dollars annually. While not all of that loss is attributable to China, multiple U.S. government assessments have identified Chinese entities as leading contributors to industrial espionage and IP misappropriation. In the case of 3D printing, the stakes are particularly high because additive manufacturing is not just a consumer product category. It is a foundational capability that underpins advanced weapons systems, custom medical implants, rapid prototyping for aerospace, and resilient domestic supply chains.

There is also a strategic dimension that Americans should not ignore. Technologies developed in civilian markets frequently migrate into military and dual-use applications. Precision motion control, advanced sensors, materials science, and automated calibration systems are as valuable to defense manufacturing as they are to desktop printers. When Chinese firms gain dominance through alleged IP theft, they are not simply selling gadgets. They are absorbing and internalizing decades of Western engineering knowledge, knowledge that can later be leveraged in state-supported industries with direct national security implications.

What makes this situation particularly concerning is the asymmetry of enforcement. American companies operate under strict legal, regulatory, and transparency requirements. Chinese firms, by contrast, often benefit from opaque corporate structures, state support, and limited accountability. Even when U.S. courts rule against Chinese entities, enforcement across borders is difficult. Import bans, injunctions, and tariffs can help, but they rarely restore lost momentum or rebuild shuttered R&D teams. Once technological leadership is ceded, reclaiming it becomes exponentially harder.

At the same time, it is important to acknowledge why this trend is tempting to overlook. Affordable Chinese printers have democratized access to manufacturing tools in ways that genuinely benefit individuals and small businesses. Students can learn engineering skills. Entrepreneurs can prototype products. Communities can innovate locally. These gains are real, and dismissing them would be dishonest. But affordability achieved through systemic infringement is not sustainable innovation. It is extraction. It transfers value from long-term creators to short-term imitators, hollowing out the ecosystem that makes future breakthroughs possible.

The danger for the United States is not that China produces competitive technology. Healthy competition drives progress. The danger is that competition becomes decoupled from rules, reciprocity, and respect for intellectual property. When copying replaces invention as the dominant growth strategy, the global market rewards speed over originality and scale over integrity. In such an environment, American firms face an uphill battle not because they lack talent or ideas, but because the system itself penalizes innovation.

For American consumers, the implications deserve serious reflection. Every purchase sends a signal. Choosing the cheapest option without regard to its origins may save money today, but it contributes to an ecosystem in which domestic innovation struggles to survive. Over time, that erosion reduces competition, increases dependence on foreign suppliers, and weakens the industrial base that underlies economic resilience. Once domestic capacity is lost, rebuilding it is costly, slow, and uncertain.

This is not a call for panic or isolation. It is a call for awareness. Americans can admire technological ingenuity while remaining vigilant about how it is achieved. They can demand transparency from manufacturers, support enforcement of intellectual property rights, and recognize that innovation is not free. It is paid for through research, failure, and perseverance. When those investments are stripped away through systematic copying, the long-term cost far exceeds the short-term bargain.

The rise of Chinese 3D-printing firms offers a warning, not just about one industry, but about a broader pattern affecting semiconductors, robotics, AI, and advanced manufacturing. The question facing the United States is not whether Chinese companies will continue to innovate. They will. The question is whether America will allow innovation to be undermined by practices that erode the very foundation of technological leadership.

If Americans want a future defined by genuine progress rather than cheap imitation, they must look beyond price tags and ask harder questions about where innovation comes from, who bears its costs, and who ultimately pays the price when it disappears.